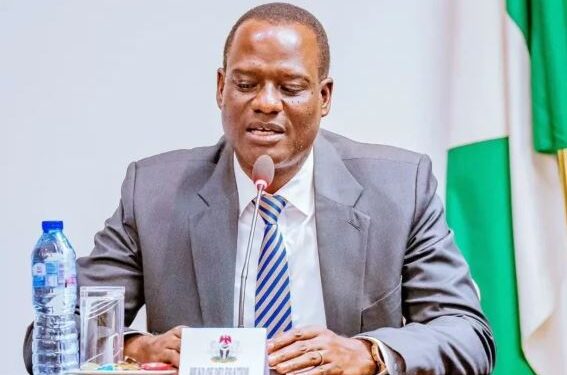

My Wife Held Daily Vigils For Me During Tax Bill Controversy – Chairman, Presidential Committee On Fiscal Policy And Tax Reforms, Taiwo Oyedele

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has opened up about the personal cost of Nigeria’s recent tax reform controversy, revealing that the emotional strain on his family has been the most significant sacrifice of his role.

Speaking on Channels Television’s Politics Today on Thursday, shortly after President Bola Tinubu signed four new tax bills into law, Oyedele recounted how the backlash affected his household.

“The biggest sacrifice turns out to be the emotional impact, particularly on my family,” said Oyedele, a former tax leader at PriceWaterhouseCoopers (PwC). “At the height of it, there were people who would cook up stories on blogs, and in newspapers, and it took a toll on my family.

“My wife, for example, was doing night vigils every night and struggled to stay awake the following day. Thank God my kids are still too young. So, they don’t know what I am going through but it’s been tough, it’s a big sacrifice.”

Appointed by President Tinubu in July 2023, Oyedele has been at the centre of an ambitious effort to overhaul Nigeria’s tax system. The reforms, however, drew fierce criticism from some quarters, including state governors who argued that certain provisions in the proposed legislation could cripple state finances.

Despite the backlash, Oyedele maintained that the new laws are designed to stimulate economic growth, track tax evasion, and protect low-income earners and businesses.

“In terms of the financial sacrifices, maybe that is now even smaller looking back. The amount the government was going to pay was going to be ridiculous. So, I said: just cover the cost of what you asked me to do; you don’t need to pay me a salary. And I’m also fine with that. It’s a small sacrifice in the context that this can make,” he said.

He stressed that the reforms are not about increasing taxes but about making the system more efficient and people-oriented.

“It’s important to make the point that if Nigerians truly want a better country, they should not discourage honest people who want to help. It’s already a tough decision to try and work in the public sector. Making it harder than it ought to be is not helpful,” he added.

The four tax bills signed into law by President Tinubu are the Nigeria Tax Bill (Ease of Doing Business), the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill. The new legislation aims to unify Nigeria’s fragmented tax laws, create a coherent legal and operational tax framework across all levels of government, and replace the Federal Inland Revenue Service with a new Nigeria Revenue Service.

President Tinubu described the new laws as central to his administration’s economic reforms and essential for Nigeria’s prosperity. While the reforms sparked initial controversy, the Presidency and the National Assembly insist that stakeholders were widely consulted and that concerns, particularly those raised by state governors, have been addressed.

The new tax laws are expected to take effect from January 2026.